Contact Us

Are you ready to take control of your financial future? Contact us today to schedule a confidential, no-obligation consultation and take the first step toward achieving your goals.

5018 Sawyer Cove Way

Windermere, FL 34786

Asset protection is a difficult topic to consider, yet it plays a vital role in securing your financial future and supporting your family. Talking about life’s unknown challenges can be tough, but confronting the reality of life expectancy, disability or long-term care needs is essential. In fact, they are an integral component of a comprehensive financial plan. Accumulating assets requires time and hard work, and it’s important to protect those assets to provide for those who matter most.

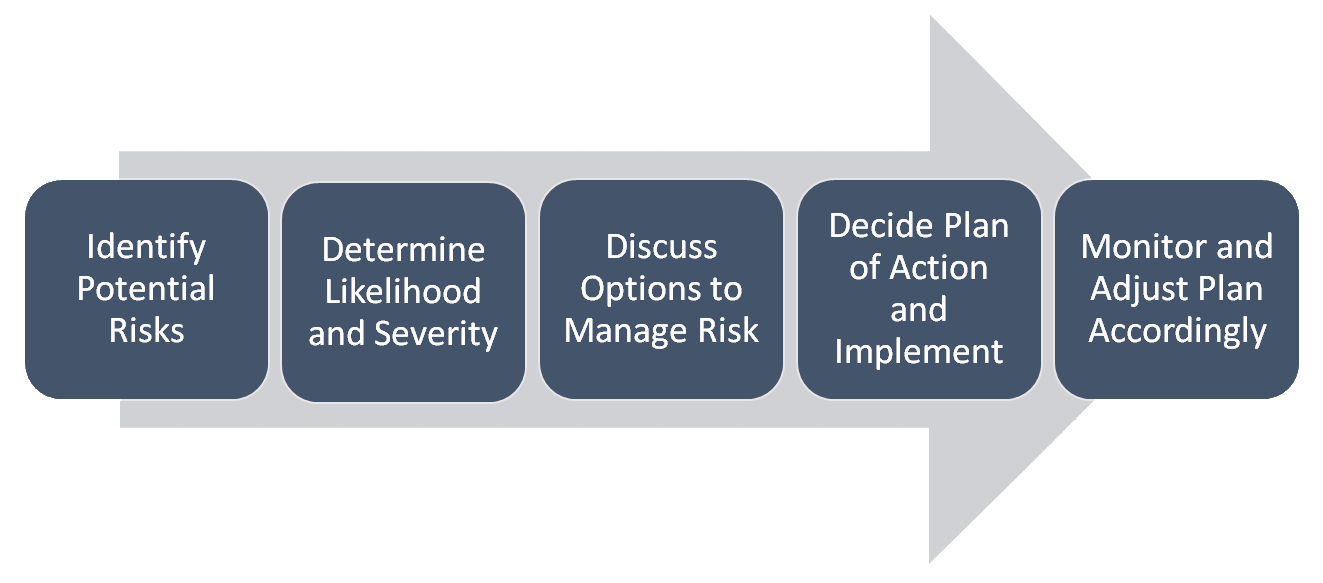

At JMK Wealth Advisors, we do not sell products, we sell a process. We let our process determine if you need a product to protect your family, we never force a product to fit your family. Instead, we refer to your financial plan to dictate whether a specific product will help you meet your goals. It’s that simple.

This focus on the process fosters trust and helps ensure our recommendations are in your best interests and aligned with your objectives. It also helps eliminate any potential conflicts of interest by allowing us to address your needs correctly, efficiently and without ulterior motives.

Almost all conversations about ensuring you and your family are protected involve insuring you and your family. Insurance can be an overly complicated product, and we aim to simplify the process by focusing only on your needs, not what the insurance company wants to sell. This approach transforms complexity into confidence, and confidence yields peace of mind. This eliminates unsuitable products and avoids unnecessary and expensive riders. In addition to homeowner and car insurance policies, this conversation can include life, disability and long-term care insurance.

Asset protection is a difficult topic to consider, yet it plays a vital role in securing your financial future and supporting your family. Talking about life’s unknown challenges can be tough, but confronting the reality of life expectancy, disability or long-term care needs is essential. In fact, they are an integral component of a comprehensive financial plan. Accumulating assets requires time and hard work, and it’s important to protect those assets to provide for those who matter most.

At JMK Wealth Advisors, we do not sell products, we sell a process. We let our process determine if you need a product to protect your family, we never force a product to fit your family. Instead, we refer to your financial plan to dictate whether a specific product will help you meet your goals. It’s that simple.

This focus on the process fosters trust and helps ensure our recommendations are in your best interests and aligned with your objectives. It also helps eliminate any potential conflicts of interest by allowing us to address your needs correctly, efficiently and without ulterior motives.

Almost all conversations about ensuring you and your family are protected involve insuring you and your family. Insurance can be an overly complicated product, and we aim to simplify the process by focusing only on your needs, not what the insurance company wants to sell. This approach transforms complexity into confidence, and confidence yields peace of mind. This eliminates unsuitable products and avoids unnecessary and expensive riders. In addition to homeowner and car insurance policies, this conversation can include life, disability and long-term care insurance.

Unknown

Are you ready to take control of your financial future? Contact us today to schedule a confidential, no-obligation consultation and take the first step toward achieving your goals.

5018 Sawyer Cove Way

Windermere, FL 34786